Table of Contents

Toggle1. Introduction

In this SWOT analysis, we present BMW SWOT analysis. The SWOT analysis focuses on internal and external factors that determine the company’s competitive strength.

2. Company overview

| What company makes BMW? | BMW Group |

| What does BMW stand for? | Bayerische Motoren Werke |

| Year founded | 1916 |

| CEO | Oliver Zipse |

| Headquarters | Munich, Germany |

| Number of countries | 140 countries |

| Number of employees | 118,909 |

| Revenue (2022) | $141.9 billion (6.02% increase from 2021) |

| Profitability (2021) | $26.01 billion (67.6% rise from 2020) |

3. BMW SWOT Analysis

3.1. BMW Strengths

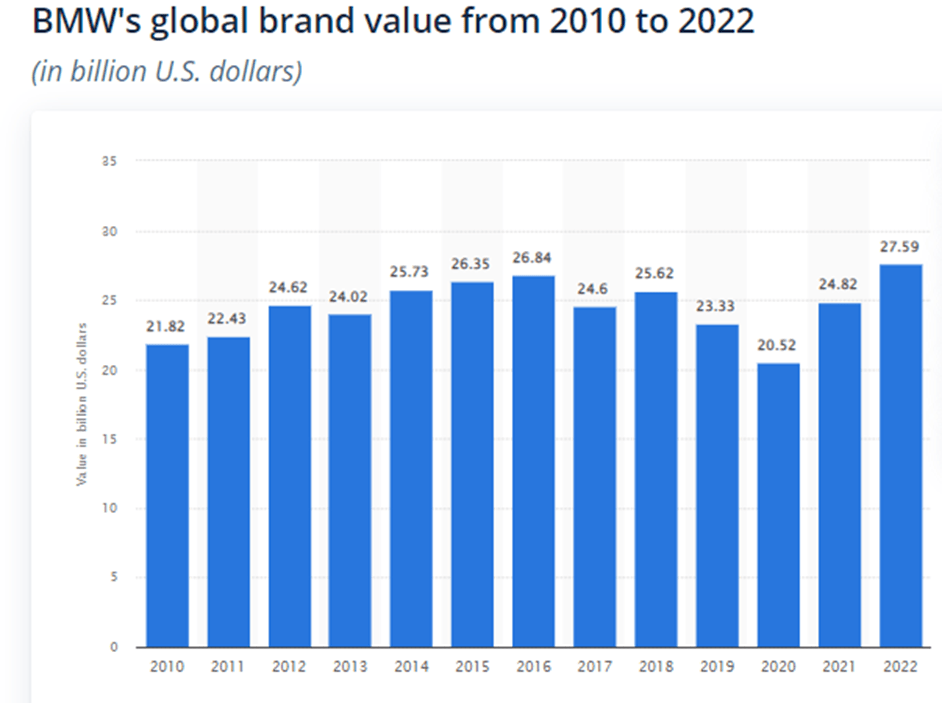

3.1.1. BMW brand value

BMW global strategy analysis indicates that it holds strong position at global stage. BMW is considered among best global brands based on strong brand value. In 2022, BMW earned 76 rank in best global brands with brand value of $27.6 billion:

Source: Statista

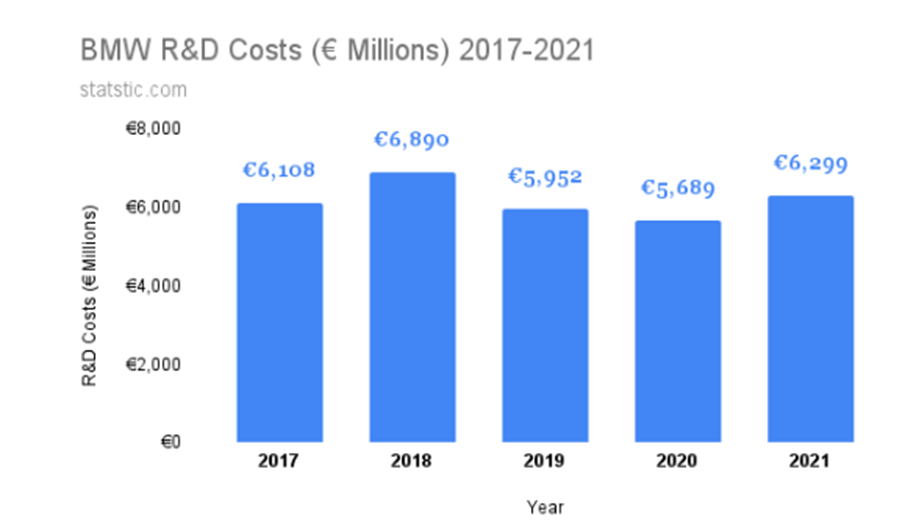

3.1.2. BMW research and development

BMW incurs heavy investments on the research and development to maintain innovation leadership. By 2025, BMW plans to invest more than 30 billion Euros on advanced technologies.

Here is the graph showing the consistent rise in BMW’s R&D costs:

Source: Statistic.com

3.1.3. BMW brand loyalty

As per J.D Power, BMW earns highest brand loyalty score of 58.6%, followed by Lexus (56.4%) in premium SUV brands.

3.1.4. Strong brand reputation

BMW holds 1st position in global premium segment. In 2022, BMW was ranked 1st in list of ‘top automotive brands’. The ranking was based on brands’ safety, reliability and performance.

3.1.5. Well-managed portfolio

BMW has a small, yet well managed portfolio. BMW Group owns BMW, Rolls Royce and Mini. BMW’s acquisition of ALPINA brand will bring greater diversity to luxury vehicle range.

3.1.6. Strong competitive positioning

Following table provides a glimpse of BMW competitor analysis:

| Diversity rank | 1st (2nd Fiat, 3rd Audi) |

| Strong corporate culture | 2nd (1st Porche, 3rd Audi) |

| Product quality | 3rd (1st Porche, 2nd Mercedez) |

| Customer service | 3rd (1st Porche and 2nd Mercedez) |

| Net promoter score | 4th (1st Porche, 2nd Mercedez and 3rd Audi) |

Source: Comparably

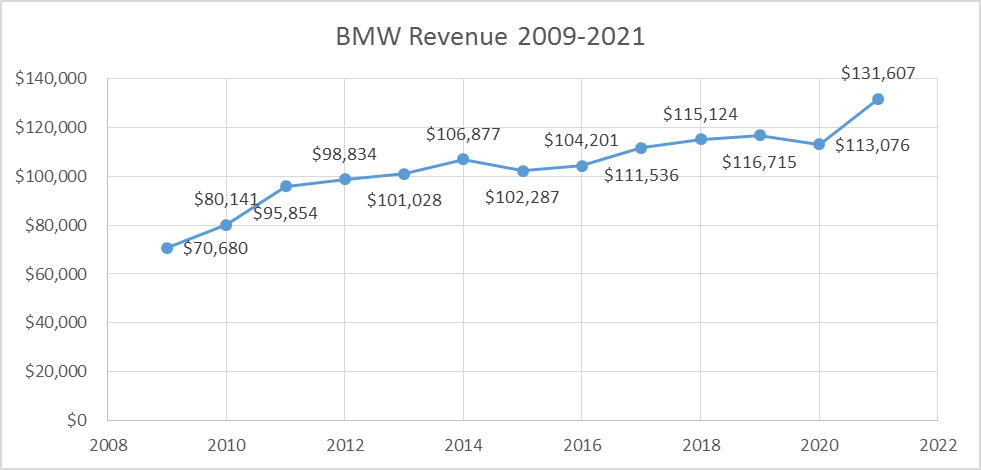

3.1.7. Strong revenue growth

BMW has successfully achieved its revenue growth objectives during 2009 to 2021. The consistent revenue growth enabled company to expand its operations around the globe:

Source: Macro-trends

3.1.8. Strong financial health

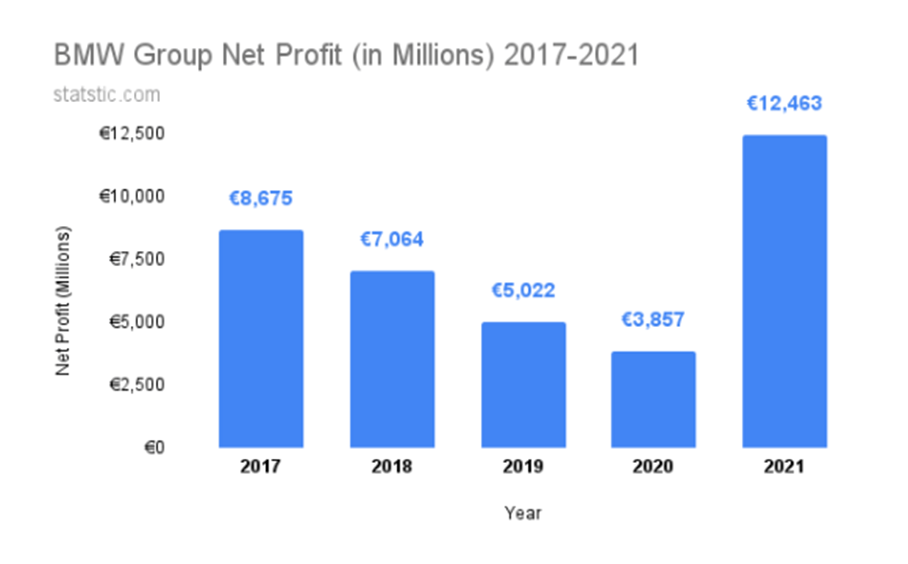

Following graph shows the consistent and sharp rise in BMW’s net income from 2017 to 2021:

Source: Statistic.com

BMW’s profit and revenue hit all time high in 2021 despite investing heavily on research and development. It happened because BMW prioritized producing higher profit models during pandemic, and tackled the chip shortage issue well.

3.1.9. Successful acquisitions and partnerships

BMW management makes wise acquisition decisions. Some recent examples of successful acquisitions include- acquisition of ALPINA brand in 2022, and Drive Now by SIXT in 2018. The acquisition of ALPINA brand enhanced BMW’s production expertise.

BMW-Boeing partnership is another success example. This partnership enabled the brand to pool their research capabilities together, and fuel the sustainable innovation. To know more about Boeing, click here.

3.1.10. Revenue diversification

BMW is investing on wireless services to generate new revenue streams. It has opened an online connected drive store. BMW’s top package is sold in 279 euros, and includes online speech processing, and over the air map.

3.1.11. Strong value chain network

BMW has spread its global sales network in more than 140 countries. Wall Street Journal recently reported how investment on block chain technologies will further enhance the BMW value chain resilience, and enable the brand to make data-driven value chain decisions.

3.1.12. Investor relations

Bayerische Motoren Werke investor relations focus on six core components, including- first class individual mobility, sustainability, innovation and flexibility, digitalization, electrification and financial performance.

3.2. BMW Weaknesses

3.2.1. High debt

BMW has 92.2% debt to equity ratio. Although, its debt to equity ratio has reduced from 175.8% to 114% in last five years, but still this ratio is considered high enough to put the brand on risk.

3.2.2. Limited portfolio

Compared to competitors like Volkswagen, BMW has limited portfolio, which limits its reach to the market.

3.2.3. Lawsuits

BMW is facing lawsuits from environment activists due to its inability to tighten the emission goals. Brand also recently faced class action lawsuit for installing cheat devices. These lawsuits hurt the brand image.

3.2.4. Reputation damaging recalls

BMW has 0.9 recall rate. In 2022, BMW recalled over 14,000 iX, i4 and i7 electric vehicles. This high product recall damages the brand reputation and hampers the customers’ trust.

3.2.5. Negative publicity

BMW paid $1.8 million dividends while its cash reserves were getting drained during pandemic. It drew scrutiny, and attracted negative publicity. This publicity is affecting BMW’s revenue from subscription based features- as reported by Bloomberg.

3.2.6. Poor marketing

BMW is struggling with bad publicity issue. However, brand is responding to the critics with bizarre marketing campaigns. Like in 2021, BMW launched a strange marketing campaign “What’s your reason not to change?” in response to the critics who disliked its electric iX model.

3.2.7. Too expensive

BMW is considered the most expensive brand to maintain because its labor cost and replacement parts are more expensive than other vehicles.

3.3. BMW Opportunities

3.3.1. Car rental industry

Car rental industry will grow with 4.6% CAGR from 2021 to 2028. BMW may find more strategic partners like SIXT to increase revenue from rental car segment.

3.3.2. Connected car market growth

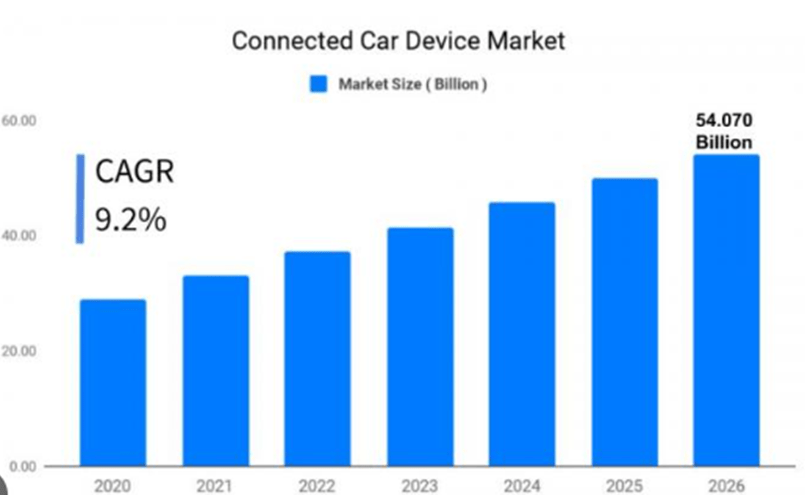

Connected car market will grow with 9.2% CAGR rate. BMW can take it as an opportunity to penetrate further into connected market segment.

Source: Open PR

3.3.3. Expansion in self-driving segment

Global self-driving car segment will grow with 13.3% CAGR from 2021 to 2030. BMW should launch more autonomous vehicles to fully exploit the growth potential.

3.3.4. Affordable luxury

As customers are becoming increasingly price sensitive, BMW should lower its prices, and launch more affordable cars to expand the market reach.

3.3.5. Geographic expansion

African electric vehicle market will grow from $11.94 billion (2021) to $21.39 billion (2027). Middle Eastern electric vehicle market will also grow with 28.1% CAGR rate. BMW may penetrate further in these areas to strengthen presence at global stage.

3.3.6. Growing environment consciousness

The automobile customers are getting environment conscious with time. BMW could position itself as an eco-friendly brand to capture this trend as a growth opportunity.

3.4. BMW Threats

3.4.1. Geopolitical tensions

Russia-Ukraine war has directly affected the European auto-manufacturers including BMW, as auto brands are forced to curtail their production- as reported by New York Times.

3.4.2. Trade war

The trade war between China and USA is also affecting the BMW’s production, since most of its production takes place in USA. So the tariffs imposed by U.S government on Chinese imports is directly affecting BMW’s production cost.

3.4.3. Chip shortage

The global semi-conductor chip shortage issue is a serious supply chain issue for auto manufacturers. The non-availability of neon supplies from Ukraine made production difficult for auto manufacturers like BMW and TESLA.

Alike BMW, TESLA is also struggling with the material shortage issue, which is not only halting its production, but is also weakening its position in the market. To know how material shortage issue is affecting TESLA, click here.

3.4.4. Intensifying competition

The electric vehicle market is facing intense competition. Competitors like Audi, Porche and Mercedez are giving tough competition to BMW. Following table shows how close competition between auto manufacturers can make it difficult for BMW to achieve its revenue growth objectives:

| Brand | Sales (2021) |

| BMW | 2,521,525 (8.4%) |

| Audi | 1,680,512 (double growth in India) |

| Porche | 3, 00,000 (8.5%) |

Source: BMW Blog| Audi| Porsche

Other than Audi and Porche, TESLA is another major competitor that is giving tough competition to BMW over price. Click here to see the TESLA-BMW price comparison.

3.4.5. Rising fuel prices

Rising fuel prices present another threat to BMW, as customers are being compelled to choose electric cars to save the fuel costs. BMW is taking initiatives by launching electric cars, but brands like TESLA are much ahead in this market. To know more about how TESLA is competing BMW through its innovative marketing strategy, click here.

3.4.6. Changing consumer trends

Young consumers (millennials and gen Z) do not want full vehicle ownership, which can reduce the BMW’s market share.

3.4.7. Strict regulations

Antitrust regulations are getting stringent with time. As per Reuters, the stringent regulations, fines and legal charges are putting brakes on BMW’s growth.

4. BMW SWOT Analysis Summary

| BMW Strengths • Strong brand value, loyalty and reputation • Strong R&D • Strong financial health • Well-managed portfolio • Successful acquisitions • Revenue diversification • Strong value chain network | BMW Weaknesses • High debt to equity • Limited portfolio • Lawsuits • Recalls and negative publicity • Poor marketing • High prices |

| BMW Opportunities • Car rental industry growth • Self-driving vehicles • Connected car segment • Affordable luxury • Expand in Africa and Middle east • More green vehicles | BMW Threats • Geopolitical tensions • Chip shortage • Intensifying competition • Rising fuel prices • Changing consumer trends • Anti-trust regulations |

5. Recommendations

Based on BMW SWOT analysis, we propose following recommendations:

• Expand portfolio of electric and autonomous vehicles

• Respond to the critics more effectively by improving the marketing campaigns

• Address negative publicity by through effective brand communication

• Launch more affordable vehicles to cater needs of price sensitive customers

• Penetrate into African and Middle Eastern electric vehicle markets.

• Find more strategic partners to enter in the rental market.

• Understand and more effectively respond to the changing regulations

6. Conclusion

BMW SWOT analysis suggests the company is currently facing various challenges that could affect its competitive positioning. The competitors like TESLA and AUDI are making it difficult for BMW to achieve its growth objectives. However, BMW is in a position to handle the identified challenges through strategic wisdom.

This article focused on BMW, which is a direct competitor to TESLA. On many grounds (like electric product portfolio and innovation), TESLA is beating BMW. Have a look on how TESLA is beating BMW through its innovative marketing strategy.

References

Statista. (2023a, January 6). BMW: brand value 2010-2022.

Zipse: “Solidarity and responsible action are called for” +++ Guidance 2020 affected by corona spread +++ Power of Choice: Next BMW 7 Series all-electric version +++ Unequivocal commitment to meeting CO2 targets +++ Quarter-on-quarter improvement in profitability in 2019 +++ Group revenues exceed 100 billion euros for the first time +++. (n.d.). BMW Group PressClub.

Pratap, A. (2022, April 28). BMW Research and development costs. Financial Data & Stats – Statstic.

2022 U.S. Automotive Brand Loyalty Study. (2022, September 26). J.D. Power.

Hodder, P. (2023, February 17). BMW tops Consumer Reports’ 2023 brand rankings. Automotive News.

BMW Revenue 2010-2022 | BAMXF. (n.d.). MacroTrends.

Pratap, A. (2022a, April 22). BMW Group Net Profits. Financial Data & Stats – Statstic.

Deloitte. (n.d.). The BMW Group Navigates a Blockchain-Driven Future. WSJ.

Bayerische Motoren Werke Aktiengesellschaft (XTRA:BMW) Health & Balance Sheet – Simply Wall St. (n.d.). Simply Wall St.

Hawkins, A. J. (2023, January 9). BMW recalls over 14,000 iX, i4, and i7 electric vehicles for faulty battery software. The Verge.

Hodge, L. (2022, August 8). BMW Hopes the Bad Press Around its Subscription-Based Features Will Blow Over. Jalopnik.

Car Rental Market Size & Share Report, 2021-2028. (n.d.).

Reports, V. (2020, June 4). Connected Car Device Market Size: Growth, Share and Forecast 2026. openPR.com.

Autonomous / Self-Driving Cars Market Research, Share, Value, Size, 2030. (n.d.). MarketsandMarkets.

Africa Electric Vehicle Market Analysis – Industry Report – Trends, Size & Share. (n.d.).

Middle East Electric Vehicle Market Growth & Industry Challenges to 2030. (n.d.). Data Bridge Market Research, https://www.databridgemarketresearch.com, All Right Reserved 2023.

A. (2022a, January 12). BMW Group sold 2,521,525 cars in 2021 to set new sales record. BMW BLOG.

Audi accelerates transformation with a strong 2021 for fully electric vehicles. (n.d.). Audi MediaCenter.

Porsche delivers more than 300,000 vehicles. (2022, December 1). Porsche Newsroom.

Staff, R. (2019, May 7). Investments, legal charge put brakes on BMW. U.S.